How science fiction and fantasy shape conviction, long-term thinking, and hypothesis-driven investing beyond trends and hype.

Note: The following contributions are personal impulses from Max Eckel. They represent individual reflections and are intended to stimulate discussion and further thought.

“Say ‘friend’ and enter.”... Mellon!

About fantasy novels, elevators, and real investment theses. I was standing in front of an office elevator in Berlin when I saw it written above the door. And I had to stop. And laugh a little. Out of pure joy. Because if you put a Lord of the Rings reference above your elevator, you’re telling people something about how you see the world.

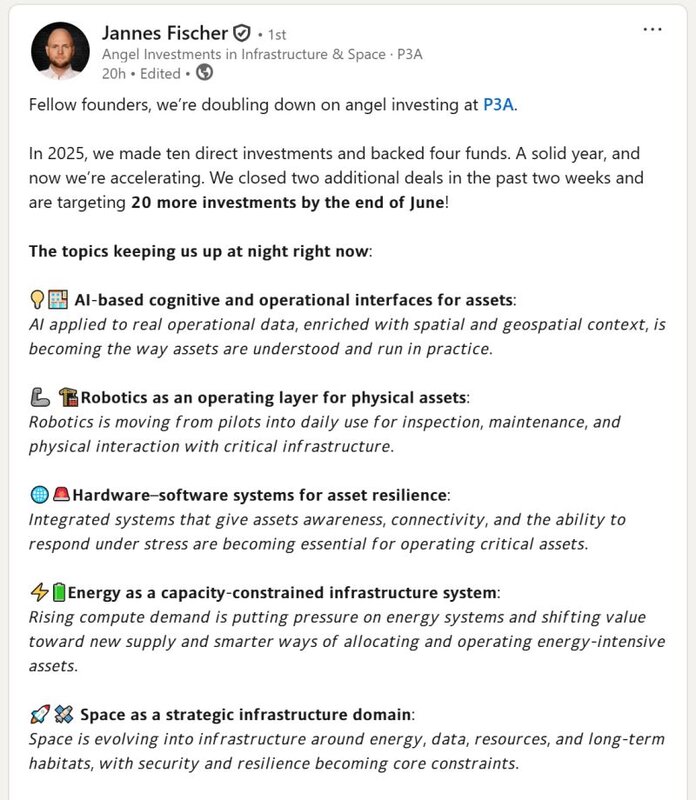

This was at the office of Jannes Fischer (BSc 2014 / Alpha28). He recently shared a post about doubling down on angel investing with P3A. I’ll add a screenshot here because the content stands on its own. What stuck with me, though, wasn’t his ambition or the numbers. It made me think about conviction and how it relates to what you care about outside of work.

I’ve noticed that some investors (and founders) don’t just react to markets. They credibly operate from stories about the future. Quiet “what if” narratives they’ve been carrying around for years. And at some point, I realized why this resonated with me so much. Jannes and I share a soft spot for ScienceFiction and Fantasy. Not in a cosplay way. More in a “this is how I learned to think about futures” way.

Science fiction is basically a long sequence of “what if…?” questions:

- What if scarcity stops being the main organizing principle of society?

- What if the most valuable skill is not building technology, but deciding when not to use it?

- What if a society can remove pain, conflict, and effort… but at the cost of ambition?

- What if humanity spreads across the galaxy but stays very human in its conflicts?

Entrepreneurs get to build answers to these questions. Authors explore them safely on paper. Investors, interestingly, get to decide which ones get oxygen. When I walked through Jannes’ office later, this clicked even more. A Star Wars cap here. Small nods to fictional universes there. Nothing loud. Just signals. This isn’t decoration. It’s orientation. It also explains why his investing feels hypothesis-driven rather than trend-driven. You don’t need to chase hype if you already have a mental model of where the world might bend next.

One more thing I really respect: he doesn’t just plug himself into the ecosystem. He pulls others in. Last year, he funded a small project that helps us keep an up-to-date overview of all the ways WHU alums can get involved with our earliest-stage entrepreneurial community. No big announcement. Just… useful. Which, in a weird way, fits perfectly. Conviction doesn’t always show up as a bold claim. Sometimes it shows up as an inscription above an elevator. Or a quiet “this might matter later” investment. Or making it easier for others to participate.

Anyway. That elevator scene stuck with me. It reminded me that the futures we build often start as the stories we take seriously long before they become “theses”.